Banking

Fear Grips Ex-Directors of Skye Bank, Seek Soft-landing

By Modupe Gbadeyanka

Information reaching Business Post indicates that all is not well with former directors of the defunct Skye Bank Plc, following a directive by federal government last week that the former bankers would be used as scapegoat to stop the incessant wrecking financial institutions by their top management staff.

Last week, Minister of Finance, Mrs Zainab Ahmed, directed the Central Bank of Nigeria (CBN) and the Nigeria Deposit Insurance Corporation (NDIC) to fully investigate and prosecute all the directors and executive management who contributed to the collapse of Skye Bank as well as other Deposit Money Banks (DMBs) in liquidation.

Mrs Ahmed said the failure of Skye Bank must be used as an opportunity to deal decisively with those behind the collapse so as to serve as a deterrent to other operators in the financial system.

According to her, federal government was no longer prepared to treat such serious infractions with levity.

The had Minister expressed her serious concern about the spate of non-performing loans in the banking industry, adding that while the bail-out of distressed financial institutions was necessary in the interest of the stability of the banking system, emphasis should also be placed on the investigation and prosecution of delinquent board directors and executive management of financial intuitions who abused the trust placed on them by depositors.

Soon after this directive, those fingered to be behind the fall of Skye Bank have started to look for ways to get a soft-landing.

According to sources in the banking sector, some of them have started consultations with their lawyers to see how they would not be “heavily dealt with.”

“I can confirm to you that even before the Minister [of Finance] gave the directive [last week], some of the former directors of Skye Bank had been making efforts to get a soft-landing.

“One thing they are aware of is that they might not escape justice because the forces behind their travails are beyond ordinary,” a top management staff of Polaris Bank, who seriously begged not to be named, told our correspondent at the weekend.

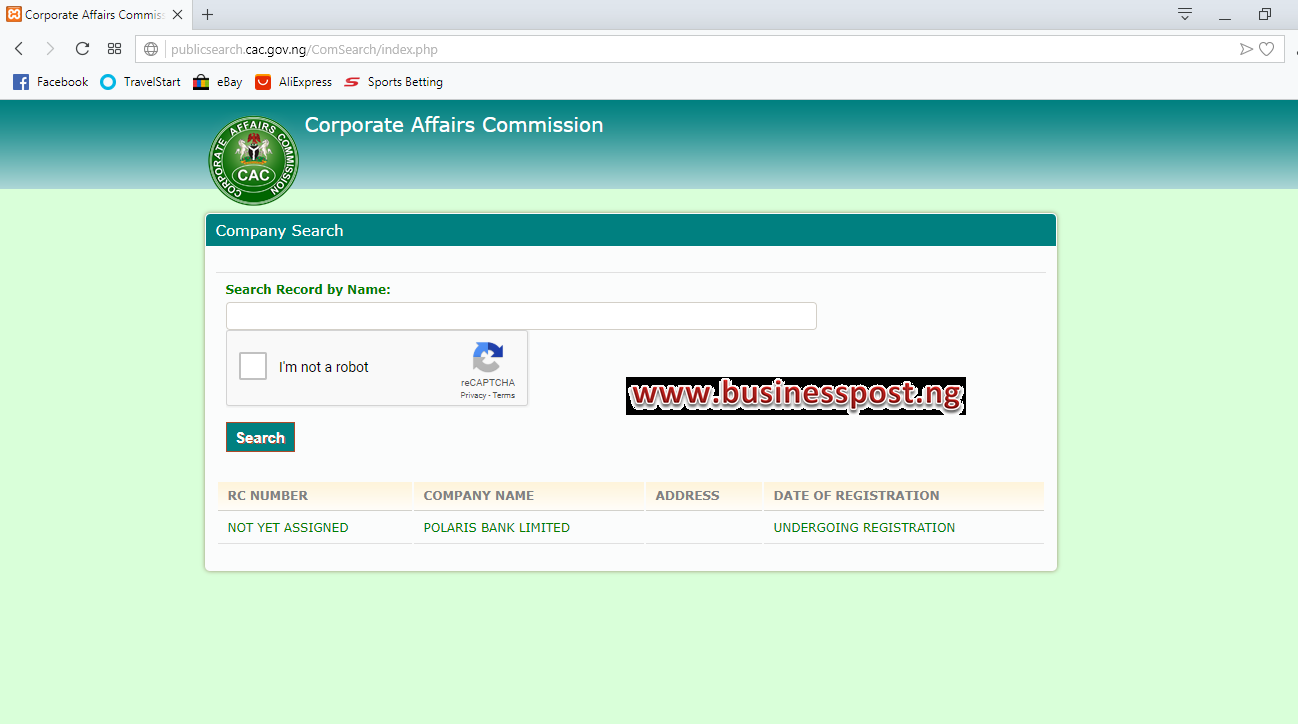

In September 2018, the CBN announced the collapse of Skye Bank, naming Polaris Bank as a bridge bank, noting that afterwards that Polaris Bank would run the financial institution until a suitable buyer is found.

In the past, not much had been done to decisively punish directors of failed banks in the country and in most cases; it is the minority shareholders who bear the brunt.

This has led many to believe that government and regulators are mere toothless bulldog, who find pleasure in making more investors lose confidence in the nation’s economy.

When Skye Bank was liquidated, many blamed the CBN, Nigerian Stock Exchange (NSE) and the Securities and Exchange Commission (SEC) for it.

Observers believed that these agencies did not do enough to protect interests of shareholders by raising the necessary red flags.

During the visit of the Finance Minister to NDIC last week, its Managing Director, Mr Umaru Ibrahim, assured her the corporation will do all it can to assist in the recovery of all the debts owed the defunct Skye Bank and other banks in liquidation.

He also expressed the agency’s determination to ensure that the directors who perpetrated in insider abuse and other illegalities in running the affairs of the bank are investigated and prosecuted by appropriate authorities.

The primary concern of the NDIC, he assured the Minister, is to ensure the safety of depositors’ funds and minimise the disruption of banking services.

Business Post recalls that last month, Mr Ibrahim had said that a former chairman of Skye Bank, Mr Tunde Ayeni, as well as a director of the defunct bank, Mr Festus Fadeyi, were being investigated by government.

He had disclosed that as soon as investigation was finalised, the necessary action would be taken and those found culpable severely dealt with.

“They are being investigated and I can assure you that when the time comes, the necessary security and law enforcement agencies would do their work,” the NDIC chief said on the sidelines of the International Association of Deposit Insurers (IADI) Africa Regional Committee (ARC) workshop in Lagos in September 2018.

It was alleged that Mr Ayeni and Fadeyi contributed to the downfall of the firm by borrowing huge amount of money that were never repaid.

While Mr Ayeni was said to have borrowed billions of Naira from the firm to fund the acquisitions of the Ibadan and Yola Electricity Distribution Companies; NITEL/M-Tel; and an energy services firm, Ascot Offshore Nigeria Limited; Mr Fadeyi, was accused of using Pan Ocean to obtain loans to fund the firm’s oil and gas upstream projects which were considered as one of the major non-performing loans amongst others.

It was said that the funds pulled out of Skye Bank allegedly by the duo and others led to the total collapse of the bank.

Banking

CBN Delists Non-Compliant Bureaux De Change Operators

By Adedapo Adesanya

The operating licences of all legacy Bureau De Change (BDC) operators who failed to meet the new licensing requirements have been revoked by the Central Bank of Nigeria (CBN).

This happened after the central bank streamlined the BDCs to 82 in order to sanitise the foreign exchange (FX) market in the country.

The latest development was revealed by the apex bank in its Frequently Asked Questions document on the current reform of the bureau de change, published on its website on Tuesday.

According to the document, the CBN has now enforced the final cutoff, declaring that any BDC that did not meet the requirements by the end of November is no longer recognised.

“The guidelines provided a transition timeline of six months from the effective date, 3 June 2024, with a deadline of 3 December 2024, for all existing BDCs to meet the requirement of the new Guidelines or lose their licence(s). However, the management of the CBN graciously extended this deadline by another six months, which ended 3 June 2025, to give ample time for as many legacy BDCs desirous of meeting the new requirements to do so.

“Consequently, any legacy BDC that failed to meet the requirements of the new Guidelines as of 30 November 2025 has ceased to be a BDC, as its licence no longer exists. Please visit the CBN website for the updated list of existing BDCs in Nigeria,” the apex bank said.

According to the CBN, before its latest decision, an extended compliance window was granted under the revised BDC Guidelines. Existing operators were initially given six months, June 3 to December 3, 2024, to satisfy the new regulatory conditions.

The CBN later granted an additional six-month extension, which elapsed on June 3, 2025, to allow more operators to align with the updated standards.

The new measures form part of broader efforts by the CBN to strengthen transparency, compliance, and stability within Nigeria’s foreign exchange market.

The new CBN regulatory framework for BDCs, introduced in February 2024, mandated BDC operators to meet higher capital requirements. Tier-1 operators are required to meet a minimum capital requirement of N2bn, while Tier-2 operators must meet N500m as MCR.

The bank added that it would continue to receive applications on its Licensing, Approval and Requests Portal from prospective promoters, and those that meet the criteria will be considered for a license.

However, the CBN said it reserves the right to discontinue the licensing of BDCs at any time.

Banking

O3 Capital to Unlock N95bn Festive Spending Boom With Blink Card

By Modupe Gbadeyanka

A non-bank credit card issuer, 03 Capital, has introduced a travel card designed to unlock the N95 billion festive spending boom in Nigeria.

The new initiative, known as the 03 Capital Blink Travel Card, promotes economic participation among returning Nigerians, expatriates, and tourists.

A statement from the financial technology (fintech) firm is available instantly to use at over 40 million merchants and ATMs nationwide.

The Blink Card, to be issued in both digital and physical form, is loaded with currency from any foreign bank card, converted to Naira, enabling transactions to be completed in the local currency.

The card offers tap-to-pay and cash withdrawals at over 40 million merchants and ATMs nationwide, making it the ideal solution for visitors to Nigeria.

It also avails Nigerians in the Diaspora to spend like locals when they return to their country of origin.

Payments for goods and services can be completed via the virtual Blink Card, linked to the O3Cards app. Funds can also be transferred instantly to all local banks and other financial institutions.

According to the World Bank, remittance inflows account for approximately 5.6 per cent of Nigeria’s gross domestic product (GDP), and the resultant spending power is unlocked when the Diaspora returns home for the festive period.

In December 2024, about N95 billion was injected into the Nigerian economy by inbound passengers – 90 per cent being diasporic Nigerians – spending on short-let accommodation and hotels, events and hospitality, nightlife and dining, and vehicle rentals. The launch of the Blink Card promises to spur this spending further, providing a significant boost to local businesses.

Blink Cards are available for collection at all Nigerian international airports, offering an immediate and hassle-free route to financial empowerment for people arriving in the country.

Blink Card carriers benefit from increased convenience, flexibility, and safety by not needing to carry large amounts of physical cash, while the ability to pre-load cards promotes smarter budgeting practices.

“We are excited to launch the Blink Card to promote greater economic participation among visitors to Nigeria.

“The card removes the needless friction and costs involved in legacy foreign exchange and cash payment processes, offering a quicker and more transparent option for spending in the country.

“As Nigerians begin travelling home for Christmas – combined with the regular traffic of arriving tourists, expatriates, and businesspeople – this is the perfect time to launch a solution catering to the financial needs of visitors, tapping into the seasonal spending boom which provides an annual lifeline for local economies and SMEs,” the chief executive of 03 Capital, Abimbola Pinheiro, stated.

Banking

Interswitch Champions Dialogue on Alternative Credit Scoring for Underserved

By Modupe Gbadeyanka

Technology leaders from across Nigeria’s digital finance ecosystem recently converged on Eko Convention Centre in Lagos to explore pathways for expanding credit access to underserved communities.

It platform for this was the 2025 Committee of e-Business Industry Heads (CeBIH) Annual Conference themed Reimagining Financial Inclusion through Cultural Shifts in Consumer Credit. Interswitch was a returning gold sponsor.

At a high-impact panel session titled Alternative Credit Scoring for the Underserved, moderated by Wunmi Ogunbiyi of the CeBIH Advisory Council, the Divisional Head of Product Management and Solution Delivery at Verve International, a subsidiary of Interswitch Group, Mr Ademola Adeniran, examined how alternative data and digital intelligence can unlock credit for millions excluded by conventional financial models.

“For us, this conversation goes beyond technology. It is about designing credit systems that truly reflect African realities.

“Millions transact daily outside traditional banking frameworks, and alternative credit scoring enables us to recognise that economic activity and responsibly convert it into access to finance.

“At Verve and Interswitch, we are committed to building the digital infrastructure that makes this inclusion scalable and sustainable,” Mr Adeniran stated.

Also, the Vice President for Sales and Account Management, Digital Infrastructure and Managed Services at Interswitch Systegra, Ms Robinta Aluyi, stressed the importance of African-led solutions in addressing the continent’s financial challenges, noting that sustainable progress must be rooted in local realities.

Interswitch’s strength, she said, lies in the fact that it was built on the continent, for the continent, with solutions designed to serve individuals, small businesses, enterprises, and government institutions across every layer of the payment value chain.

She also emphasized the company’s purpose-driven approach to building the infrastructure that powers Africa’s digital economy and enabling secure money movement on a scale.

“Interswitch helps people navigate their daily lives with greater ease. We make transactions flow safely and reliably. We do this by connecting banks, supporting secure and reliable payments, and strengthening the entire value chain of digital finance.

“Today, we hold a significant portion of the market, and that achievement reflects the deep trust our banking and fintech partners place in our platforms. We continue to deliver because the ecosystem has worked with us every step of the way,” Ms Aliyu said.

There were also contributions from Munachimso Duru, Head, Products, Partnership and Innovation, Afrigopay Financial Services Limited; Damola Giwa, Country Manager, Visa West Africa; Nike Kolawole, representing Aisha Abdullahi, Executive Director, Credit and Portfolio Management, CREDICORP; and Ifeanyi Chukuwekem, Head, Corporate Strategy Department, eTranzact, offering a broad industry perspective on the future of responsible credit delivery.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn