Economy

Group Accuses Okomu Oil of Using Fake RSPO Certification

By Dipo Olowookere

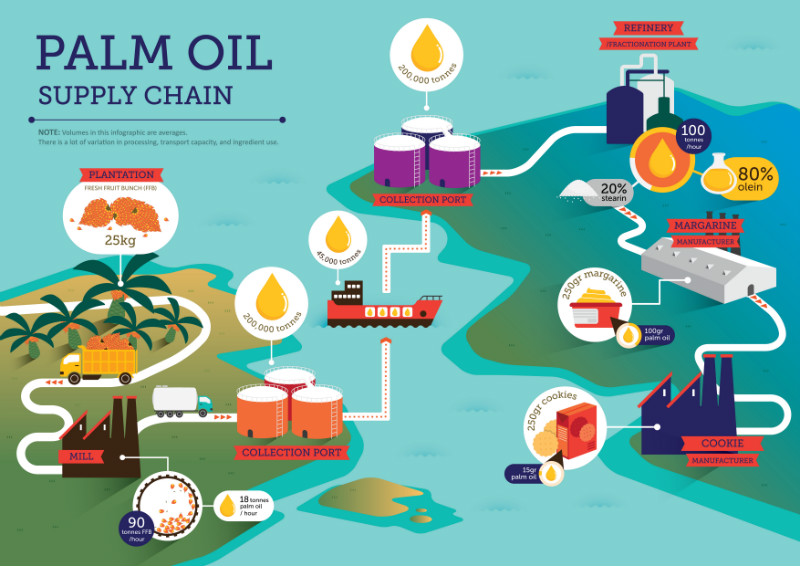

Nigeria-based company engaged in processing of oil palm, Okomu Oil Plc, has been accused of deceiving members of the public by falsely saying it has the Roundtable on Sustainable Palm Oil (RSPO) certificate.

RSPO certification is an assurance to the customer that the standard of palm oil production is sustainable.

Palm oil producers are certified through strict verification of the production process to the stringent RSPO Principles and Criteria for Sustainable Palm Oil Production by accredited Certifying Bodies, and can be withdrawn at any time in case of infringement of the rules and standards.

At a press briefing in Benin City, Edo State on Tuesday, a group known as the Environmental Rights Action/Friends of the Earth (ERA/FOEN) alleged that Okomu Oil Plc has not met the RSPO requirements and asked the firm to stop parading the certificate.

“Okomu Oil Plc, RSPO certification is a false solution because it does not address environmental and socio problems in a community. The oil firm should stop parading itself as having RSPO certified compliance.

“They are not meeting RSPO guidelines and standards yet they continued to enjoy the advertisement and putting this logo on their signpost. We called on them to remove the RSPO certification from their narrative forthwith,” the group told newsmen at the briefing.

According to the Executive Director of ERA/FOEN, Mr Godwin Uyi Ojo, who addressed the media, Okomu Oil Plc is not amongst the over 3,500 companies, who are worldwide members of RSPO.

He explained that the palm oil giant was not certified by RSPO, but pointed out that its mainstream shareholder firm, Socfin, which controls its major shares, is an RSPO member.

Recall that Okomu Oil Plc and other investors in the palm oil industry in the state last April presented and launched the Nigeria National Interpretation of Round table on Sustainable Palm Oil (RSPO) to the public in Benin-City.

The communities are located in Ovia South-West, Ovia North-East, Uhunmwode and Owan West local government areas.

“On Socfin’s website there are some certifications Okomu Plc has in Nigeria, but are not directly linked to RSPO certification, covering its acclaimed 36,000 hectares plantation. Okomu Plc is not known to have formally applied to be a member.

“Okomu Oil Plc has no RSPO certification. Still, it publicly claims to uphold RSPO certification procedures in its operations, whereas this does not amount to direct RSPO membership. It does not also suggest the certification of its plantations and socio-economic gauges. Evidently, the company was part of RSPO meeting. The company is not certified by the RSPO.

“Okomu Oil palm company Plc asserts to have been given some certification in the category of International Organization for Standardization (ISO), through a bureau Veritas. Nevertheless, Okomu Plc’s certification status with the main Roundtable on Sustainable Palm Oil (RSPO), is vague, but the company is hesitant declaring its true standing,” he informed journalists.

Mr Ojo noted that the RSPO categorically state that there shall be no deforestation in areas of oil palm, whether new or expanding plantation, stressing that from Odiguette community in Ovia North-East, Igbobazuwa, Okomu communities in Ovia South-West to Sabo-Gida community in Owan West and Uhunmwode local government deforestation has taken massively.

He maintained that with the continued deforestation, Okomu Oil Plc cannot parade itself as having RSPO certificate.

He further admonished Okomu Oil Plc to stop all forms of oil palm plantation expansion that are detrimental to community farmlands, biodiversity hotspots and historical sites, settle all outstanding cases of compensation arising from destroyed crops and farmlands, halt environmental and rights violations and evictions of communities in its areas of operation and halt using any form of armed military personnel to molest and intimidate the people among.

Meanwhile, efforts by Business Post to reach out to the management of Okomu Oil Plc proved abortive as at the time of filing this report.

However, we promise to intensify our efforts to reach the company to have their reaction to this issue.

Economy

CSCS, Geo-Fluids, FrieslandCampina Lift NASD OTC Bourse by 0.62%

By Adedapo Adesanya

Three bellwether stocks lifted the NASD Over-the-Counter (OTC) Securities Exchange by 0.62 per cent on Friday, December 12 with the NASD Unlisted Security Index (NSI) jumping by 22.20 points to 3,600.43 points from 3,578.23 points.

In the same vein, the market capitalisation of the trading platform increased by N13.28 billion to close at N2.154 trillion from the previous day’s N2.140 trillion.

During the session, Central Securities Clearing System (CSCS) Plc went up by N2.53 to close at N39.71 per share compared with the previous day’s N37.18 per share, Geo-Fluids Plc added 35 Kobo to its price to finish at N5.00 per unit versus Thursday’s closing price of N4.65 per unit, and FrieslandCampina Wamco Nigeria Plc appreciated by 23 Kobo appreciation to sell at N60.23 per share versus N60.00 per share.

It was observed that yesterday, the price of Golden Capital Plc went down by N1.05 to N9.45 per unit from N10.50 per unit, and UBN Propertiy Plc declined by 21 Kobo to N2.01 per share from the N2.22 per share it was traded a day earlier.

There was a significant improvement in the level of activity for the day, as the volume of transactions increased by 6.2 per cent to 37.4 million units from the previous day’s 35.2 million units, the value of trades went up by 265.1 per cent to N4.9 billion from N1.4 billion, and the number of deals soared by 13.80 per cent to 33 deals from 29 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc ended the last trading day of this week as the most active stock by value on a year-to-date basis with 5.8 billion units valued at N16.4 billion, the second spot was taken by Okitipupa Plc with 178.9 million units traded for N9.5 billion, and third space was occupied by a new comer in MRS Oil Plc with 36.1 million units worth N4.9 billion.

InfraCredit Plc also finished the session as the most active stock by volume on a year-to-date basis with 5.8 billion units transacted for N16.4 billion, followed by Industrial and General Insurance (IGI) Plc with 1.2 billion units valued at N420.3 million, and Impresit Bakolori Plc with 537.0 million units sold for N524.9 million.

Economy

Guinness Nigeria, Others Buoy NGX Index 1.00% Growth

By Dipo Olowookere

The bullish run on the Nigerian Exchange (NGX) Limited continued on Friday with a further 1.00 per cent growth buoyed by gains recorded by Guinness Nigeria, Champion Breweries, and others.

Data showed that the consumer goods space expanded by 1.53 per cent during the last trading session of the week, as the insurance counter grew by 0.51 per cent, and the industrial goods sector marginally gained 0.01 per cent.

However, the banking index depreciated by 0.54 per cent due to a pocket of profit-taking, and the energy industry shrank by 0.09 per cent, while the commodity sector closed flat.

Guinness Nigeria gained 10.00 per cent to trade at N217.80, Morison Industries rose by 9.84 per cent to N4.69, Champion Breweries jumped by 9.69 per cent to N14.15, Austin Laz grew by 9.66 per cent to N2.27, and C&I Leasing appreciated by 9.62 per cent to N5.70.

Conversely, eTranzact lost 10.00 per cent to finish at N12.60, Chellarams slumped by 9.00 per cent to N13.20, Eunisell depleted by 9.89 per cent to N75.15, Africa Prudential moderated by 9.77 per cent to N12.00, and DAAR Communications decreased by 9.18 per cent to 89 Kobo.

The busiest stock on Friday was Access Holdings with 107.6 million units sold for N2.2 billion, Consolidated Hallmark traded 59.9 million units worth N245.8 million, Zenith Bank transacted 48.2 million units valued at N3.1 billion, Transcorp Power transacted 42.8 million units for N13.1 billion, and Champion Breweries exchanged 36.4 million units valued at N510.2 million.

At the close of business, a total of 602.8 million units worth N30.7 billion exchanged hands in 20,550 deals yesterday, in contrast to the 529.7 million units valued at N12.3 billion traded in 18,159 deals on Thursday, representing a surge in the trading volume, value, and number of deals by 13.80 per cent, 149.59 per cent, and 13.17 per cent apiece.

Business Post reports that the All-Share Index (ASI) soared during the session by 1,485.89 points to 149,436.48 points from 147,950.59 points and the market capitalisation moved up by N945 billion to N95.264 trillion from N94.319 trillion.

Economy

Naira Chalks up 0.11% on USD at NAFEM as CBN Defends Market

By Adedapo Adesanya

An intervention of the Central Bank of Nigeria (CBN) in the foreign exchange (FX) market eased the pressure on the Naira on Friday.

The apex bank sold forex to banks and other authorised dealers in the official window to defend the domestic currency, helping to calm the FX demand pressure, with the Nigerian currency appreciating against the US Dollar in the Nigerian Autonomous Foreign Exchange Market (NAFEM) by 0.11 per cent or N1.57 to sell at N1,454.50/$1 compared with Thursday’s closing price of N1,456.07/$1.

Also, the domestic currency improved its value against the Pound Sterling in the official market yesterday by N3.95 to close at N1,946.15/£1 versus the previous day’s N1,950.11/£1 but lost 10 Kobo on the Euro to quote at N1,706.46/€1 compared with the N1,706.36/€1 it was exchanged a day earlier.

At the black market segment, the Nigerian Naira maintained stability against the Dollar during the session at N1,470/$1 and also traded flat at N1,463/$1 at the GTBank forex counter.

Despite the sigh of relief, demand pressures outweighed the robust supply from the CBN and inflow from offshore players looking to participate at the OMO bills auction.

Gross FX reserves increased for the twenty fifth consecutive week, growing by a strong $396.84 million week-on-week to $45.44 billion.

As for the cryptocurrency market, it was down on Friday as pressure remained after Federal Reserve chair Jerome Powell’s speech on Wednesday, which hinted at a possible rate cut pause in January. As a result, markets now expect only two rate cuts in 2026 instead of three.

However, Chicago Federal Reserve President Austan Goolsbee, who was against a December rate cut, said he expects more in 2026 than the current median projection.

Ethereum (ETH) slumped by 5.1 per cent to $3,090.61, Solana (SOL) declined by 4.5 per cent to $132.79, Cardano (ADA) depreciated by 3.8 per cent to $0.4103, and Dogecoin (DOGE) dropped 2.5 per cent to trade at $0.1373.

In addition, Bitcoin (BTC) lost 2.4 per cent to sell at $90,342.74, Litecoin (LTC) tumbled by 1.9 per cent to $81.86, Binance Coin (BNB) fell by 0.6 per cent to $886.93, and Ripple (XRP) slipped by 0.5 per cent to $2.02, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn