Economy

$2.5b Currency Swap: CBN Appoints Four Lenders as Settlement Banks

By Dipo Olowookere

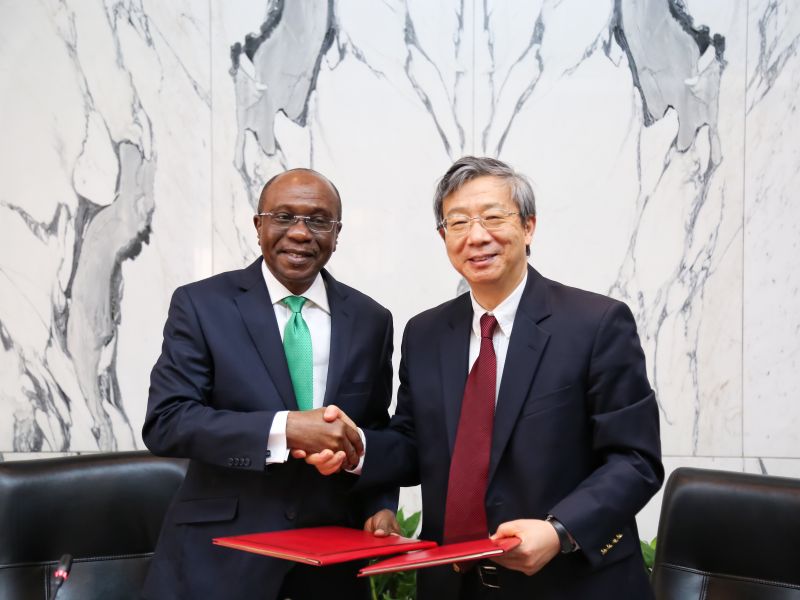

Four banks have been appointed by the Central Bank of Nigeria (CBN) as settlement banks for the $2.5 billion currency swap deal signed between Nigeria and China last Friday in Beijing.

According to a report by ThisDay, the four financial institutions appointed by the apex bank are First Bank of Nigeria Limited, Stanbic IBTC, Standard Chartered Bank (SCB) and Zenith Bank Plc.

Last Friday, the CBN, on behalf of Nigeria, sealed the much-awaited $2.5 billion bilateral currency swap agreement with the People’s Bank of China (PBoC).

The settlement banks are expected to handle the trade obligations that would enable an importer in Nigeria, after filling the required documentation, to easily exchange the Naira for the Renminbi (RMB) instead of resorting to third currencies such as the US Dollar, while the reverse will be the case for importers in China that trade with Nigerian businesses.

Quoting a source at the CBN privy to the deal, ThisDay said while two of the banks will begin work immediately, the two others will have to upgrade their statuses in China.

Standard Chartered Bank and Stanbic IBTC already have operational offices in China, while Zenith Bank and First Bank have representative offices in Beijing.

“While SCB already has a presence in China through its Standard Chartered Bank (China) Limited, Stanbic has been trading in the country through its affiliate, the Investment and Commercial Bank China (ICBC).

“However, FBN and Zenith Bank were also appointed because they already have representative offices in China.

“So, while SCB and Stanbic can start immediately, it would take FBN and Zenith Bank some time to join the settlement arrangement because they would have to convert their representative offices to operational offices.

“This whole swap agreement would kick off likely before June because we have to operationalise the settlement arrangement with the relevant institutions,” the source quoted in the report said.

It was gathered that these banks, to be responsible for settling the trade transactions between importers and exporters from both countries, will likely take off just before next month.

The source explained further that the currency swap by the two central bank governors was partly facilitated by the improving economic environment in Nigeria.

“As you know, negotiations have been on-going for two years, so yes to some extent, the improvement in foreign reserves and government revenues, drop in the inflation rate, and the uptick in economic activities, played a role in getting the swap with the PCoB.

“But this was not the only reason factored into the negotiations, as there were other bilateral reasons which I am not at liberty to disclose,” she said.

When asked about the impact on the country’s external reserves, the source pointed out that China is Nigeria’s largest trading partner, accounting for about 35 percent of trade.

However, the National Bureau of Statistics’ (NBS) Fourth Quarter (Q4) 2017 Foreign Trade Statistics put China’s trade with Nigeria at 22 percent, making it a major trading partner. The total value of trade in Q4 2017 was put at N465.13 billion.

According to the CBN source, the currency swap will play a role in reserves management as pressure from Nigerian importers seeking to source dollars will now dissipate.

“Of course, this will help in terms of management of our reserves. What this means is that pressure on Nigerian importers seeking to source dollars to import goods from China will completely dissipate,” she explained.

Yesterday, the CBN, through its spokesman, Mr Isaac Okorafor, said in a statement on Thursday that among other benefits, the agreement is expected to provide Naira liquidity to Chinese businesses and provide RMB liquidity to Nigerian businesses respectively, thereby improving the speed, convenience and volume of transactions between the two countries.

Also, the currency swap is aimed at providing adequate local currency liquidity to Nigerian and Chinese industrialists and other businesses thereby reducing the difficulties encountered in the search for third currencies.

Furthermore, the deal will make it easier for most Nigerian manufacturers, especially small and medium enterprises (SMEs) and cottage industries in manufacturing and export businesses to import raw materials, spare -parts and simple machinery to undertake their businesses by taking advantage of available RMB liquidity from Nigerian banks without being exposed to the difficulties of seeking other scare foreign currencies.

The deal, which is purely an exchange of currencies, will also make it easier for Chinese manufacturers seeking to buy raw materials from Nigeria to obtain enough Naira from banks in China to pay for their imports from Nigeria.

The CBN said this will protect Nigerian business people from the harsh effects of third currency fluctuations.

Economy

5 Secrets to Unlocking Business Success in Nigeria

Nigeria’s business environment continues to evolve rapidly, presenting both opportunities and challenges for entrepreneurs. In recent years, digital transformation has become a cornerstone for growth, with businesses across various sectors embracing new technologies to remain competitive. For those looking to thrive in this dynamic landscape, understanding market trends and leveraging innovative strategies is crucial.

Whether it’s a startup or an established enterprise, success often hinges on adaptability, strategic planning, and the ability to seize emerging opportunities. Even in sectors like entertainment and sports, where trends shift quickly, businesses must stay agile to maintain relevance. For instance, some entrepreneurs are exploring new revenue streams such as online platforms, including activities like แทงบอล ufabet, which have gained popularity due to their accessibility and appeal to a broad audience.

The Nigerian Business Landscape in 2025

The Nigerian business landscape in 2025 is marked by rapid technological adoption, increased competition, and a growing demand for digital solutions. Sectors such as fintech, e-commerce, and digital marketing have seen significant growth, driven by a young, tech-savvy population. Entrepreneurs are now leveraging digital tools to streamline operations, reach wider audiences, and improve customer engagement. The government’s push for economic diversification has also created new opportunities in agriculture, manufacturing, and renewable energy. However, businesses must navigate challenges such as regulatory hurdles, infrastructure gaps, and fluctuating market conditions. Despite these obstacles, the resilience and creativity of Nigerian entrepreneurs continue to drive innovation and growth.

Why Strategic Planning is Essential

Strategic planning is the foundation of any successful business. It involves setting clear goals, identifying resources, and developing actionable steps to achieve objectives. In Nigeria’s competitive market, businesses that invest time in strategic planning are better equipped to anticipate challenges, capitalize on opportunities, and adapt to changing circumstances. Effective planning also helps businesses allocate resources efficiently, minimize risks, and maximize returns. Entrepreneurs should regularly review and update their strategies to stay aligned with market trends and customer needs. By doing so, they can maintain a competitive edge and position their businesses for long-term success.

Leveraging Digital Tools for Growth

Digital tools have revolutionized the way businesses operate in Nigeria. From cloud-based software to social media platforms, these tools enable businesses to automate processes, enhance communication, and reach a global audience. For example, e-commerce platforms allow businesses to sell products online, while digital marketing tools help them target specific customer segments and measure campaign effectiveness. Additionally, mobile payment solutions have made transactions faster and more secure, improving customer satisfaction. By embracing digital transformation, businesses can increase efficiency, reduce costs, and expand their market reach.

Building a Strong Team Culture

A strong team culture is vital for business success. It fosters collaboration, boosts morale, and drives innovation. Nigerian entrepreneurs should prioritize creating a positive work environment where employees feel valued and motivated. This can be achieved by promoting open communication, recognizing achievements, and providing opportunities for professional development. A cohesive team is more likely to overcome challenges, generate creative solutions, and contribute to the overall growth of the business. Investing in team-building activities and leadership training can further strengthen the organizational culture.

Overcoming Common Challenges

Nigerian businesses face a range of challenges, including access to finance, regulatory compliance, and competition. Access to capital remains a major hurdle for many entrepreneurs, particularly startups and small businesses. Regulatory compliance can also be complex and time-consuming, requiring businesses to stay informed about changing laws and policies. Additionally, intense competition in key sectors can make it difficult for businesses to differentiate themselves. To overcome these challenges, entrepreneurs should seek support from government agencies, industry associations, and financial institutions. Building strong networks and partnerships can also provide valuable resources and guidance.

Adapting to Market Trends

Adapting to market trends is essential for staying relevant in Nigeria’s fast-paced business environment. Entrepreneurs must stay informed about emerging trends, consumer preferences, and technological advancements. This can be achieved by conducting market research, attending industry events, and monitoring competitor activities. By anticipating changes and responding proactively, businesses can seize new opportunities and mitigate potential risks. For example, the growing demand for sustainable products and services presents opportunities for businesses to innovate and differentiate themselves.

Importance of Financial Management

Effective financial management is critical for business sustainability and growth. It involves budgeting, cash flow management, and financial reporting. Nigerian entrepreneurs should prioritize financial literacy and seek professional advice when needed. Proper financial management enables businesses to track performance, make informed decisions, and secure funding. It also helps businesses comply with regulatory requirements and build trust with stakeholders. By maintaining sound financial practices, entrepreneurs can ensure the long-term viability of their businesses.

Future Outlook for Nigerian Entrepreneurs

The future outlook for Nigerian entrepreneurs is promising, with continued growth expected in key sectors such as technology, agriculture, and renewable energy. The government’s focus on economic diversification and infrastructure development is likely to create new opportunities for businesses. Additionally, the rise of digital platforms and e-commerce is expected to drive innovation and expand market reach. Entrepreneurs who embrace change, invest in digital transformation, and prioritize strategic planning are well-positioned to succeed in Nigeria’s evolving business landscape.

Economy

FG, States, LGs Share N1.928trn From November 2025 Revenue

By Adedapo Adesanya

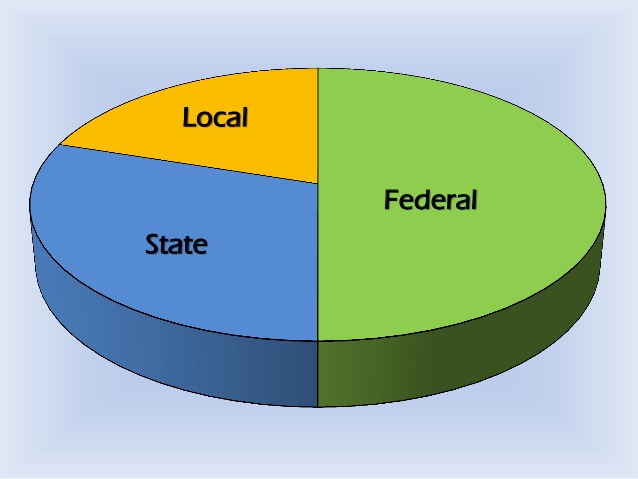

The federal government, states and the Local Government Councils have received a sum of N1.928 trillion from the revenue generated in November 2025 by the federation.

According to a statement by the Federation Account Allocation Committee (FAAC), the earnings were shared at the December 2025 FAAC meeting held in Abuja, where the total distributable revenue comprised statutory revenue of N1.403 trillion, Value Added Tax (VAT) revenue of N485.838 billion, and Electronic Money Transfer Levy (EMTL) revenue of N39.646 billion.

It was disclosed that total gross revenue of N2.343 trillion was available in the month of November 2025, with N84.251 billion deducted for cost of collection and N330.625 billion for total transfers, interventions, refunds and savings.

FAAC stated that gross statutory revenue of N1.736 trillion was received for the month of November 2025, lower than the N2.164 trillion received in the month of October 2025 by N427.969 billion.

Gross revenue of N563. 042 billion was available from VAT in November 2025, lower than the N719.827 billion available in the month of October 2025 by N156.785 billion.

In November 2025, Excise Duty increased moderately while Petroleum Profit Tax (PPT), Hydrocarbon Tax (HT), CIT on Upstream Activities, Companies Income Tax (CIT), CGT and SDT, Oil & Gas Royalties, Import Duty, CET Levies, Value Added Tax (VAT), Electronic Money Transfer Levy (EMTL) and Fees recorded substantial decreases.

From the N1.928 trillion total distributable revenue, the federal government got N747.159 billion, the state governments received N601.731 billion, and the local councils shared N445.266 billion, while N134.355 billion was given to benefiting states as 13 per cent of mineral derivation.

On the N1.403 trillion distributable statutory revenue, the national government received N668.336 billion, the 36 states got N338.989 billion, and the LGAs received N261.346 billion, and N134.355 billion shared as 13 per cent of mineral revenue.

In addition, from the N485.838 billion distributable VAT revenue, the central government got N72.876 billion, the state governments shared N242.919 billion, and the local councils shared N170.043 billion.

Further, N5.947 billion was taken by the federal government from the N39.646 billion EMTL, the states shared N19.823 billion, and the councils received N13.876 billion.

Economy

Golden Capital, FrieslandCampina Trigger 0.04% Loss at NASD OTC Exchange

By Adedapo Adesanya

The duo of Golden Capital Plc and FrieslandCampina Wamco Nigeria Plc weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.04 per cent on Monday, December 15.

This pulled down the NASD Unlisted Security Index (NSI) by 1.37 points to 3,599.06 points from last Friday’s 3,600.43 points and the market capitalisation lost N820 million to close at N2.153 billion compared with the preceding session’s N2.154 trillion.

Golden Capital Plc depleted by 94 Kobo to end at N8.51 per share compared with N9.45 per share and FrieslandCampina Wamco Nigeria Plc depreciated by 63 Kobo to sell at N59.60 per unit versus N60.23 per unit.

During the session, the volume of securities traded at the session slumped by 98.4 per cent to 600,402 units from 37.4 million units, the value of securities fell by 99.8 per cent to N7.8 million from N4.9 billion, and the number of deals shed 36.4 per cent to 21 deals from 33 deals.

At the close of trades, Infrastructure Credit Guarantee Company (InfraCredit) Plc remained the most traded stock by value with a year-to-date sale of 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units worth N4.9 billion.

InfraCredit Plc was also the most traded stock by volume on a year-to-date basis with 5.8 billion units worth N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with the sale of 1.2 billion units for N420.3 million, and Impresit Bakolori Plc with 537.0 million units traded for N524.9 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn