Banking

UBA Expects Overseas Operations to Boost 2018 Earnings

By Dipo Olowookere

Last month, the United Bank for Africa (UBA) Plc announced that its London subsidiary had been given the permission to operate wholesome banking activities in the United Kingdom.

This made the Africa’s global bank the only Sub-Saharan African lender to conduct banking operations in New York and London, as well as 20 other African countries.

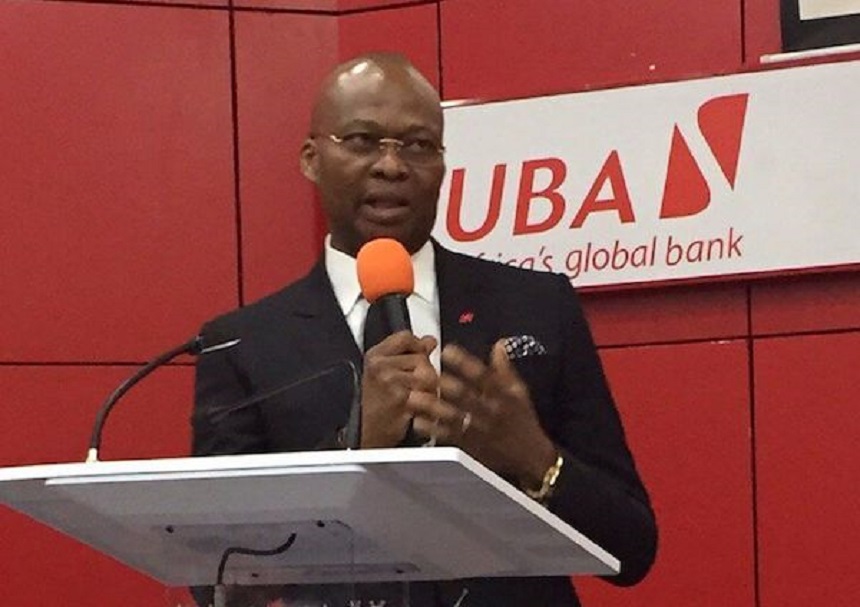

For the Head of Investor Relations at UBA, Mr Abiola Rasaq, this development will boost earnings of the financial institution in 2018.

Speaking with newsmen at a briefing in Lagos last week, Mr Rasaq noted that with the expansion to the UK and the US, UBA would record more business from its operations in those jurisdictions.

“We took a decisive step to expand our business in London. We have a subsidiary in London, which is in addition to the New York office.

“To the best of our knowledge, we are the only Nigerian bank that has a deposit-taking licence in the United States. No other bank in Nigeria does that. And we say that proudly because today, we also service the correspondent banking needs of a number of Nigeria banks in the USA because of our deposit-taking licence.

“So, what we did was to take our business in the UK a little further by applying to the UK Prudential Regulation Authority, which is more or less like their central bank. We applied to the PRA and invariably to the Financial Conduct Authority of the UK.

“Just early this year, we were given the authorisation to deepen and expand our business in the UK.

“We are happy to say that 2018 going forward, you will see more business going through our UK business,” Mr Rasaq told journalists at the press conference.

Commenting the lender’s mobile banking app, Mr Rasaq said the platform has recorded a huge success, emerging highest at 4.2 among other Nigerian banks’ apps in the Google Store,

“There is lot of things we are doing around our digital banking, because we have seen that this is the way to go; that if the future of banking.

“To that extent, the best thing to do is to continue to go digital, so that we can serve our customer best,” he said.

Mr Rasaq said the bank will continue to grow the business and make it a world class financial institution and an envy of the continent.

Also speaking at the event, the Group Chief Finance Officer of UBA, Mr Ugo Nwaghodoh, attributed the bank’s improved performance in the 2017 financial year to prudent balance sheet management, among other things.

In its 2017 earnings, UBA recorded gross earnings of N462 billion, a 20 percent growth in overall revenue for the year.

This, according to Mr Nwaghodoh, was due to growth in loan book and treasury assets, as well as efficient balance sheet management.

“The yield environment was positive and relatively high during the first half of the year. Despite growing our revenue, we also had strong control on our cost of funding.

“The banking business is intermediation. How efficient you are in the intermediation process is very vital. This borders on how much you bought money and sold money.

“Cost of funding was kept under significant check despite the tight liquidity environment you saw in the second half of the year. We were able to keep our weighted average cost of fund at 3.7 percent.

“We kept it constant from 2016 in a market where fixed deposit interest rate went as high as 20 percent.

“That efficiency in interest income and cost of funding side led to a net interest income growth of about 25 percent,” he said.

In its financial statements for the year ended December 31, 2017, UBA declared a profit after tax of N78.6 billion compared with N72.3 billion in the corresponding period of 2016, while it achieved a profit before tax of N105.3 billion in 2017 against N90.6 billion in 2016.

In addition, the bank achieved an interest income of N325.7 billion against N264 billion in 2016, while the net interest income stood at N207.6 billion as at December 31, 2017 compared with N165.2 billion as at December 31, 2016.

For the net trading and foreign exchange income, it closed at N49.1 billion in the period under review against N43.8 billion in 2016.

In 2017, the group’s Nigeria operations contributed N314.5 billion to the total N461.6 billion generated as revenue compared with N268.8 billion in 2016, while the rest of Africa added N150.7 billion to the revenue versus N121.9 billion in 2016, and its operations outside Africa added N12.6 billion last year against N9.8 billion two years ago.

Furthermore, out of the N78.6 billion raked as profit in 2017, Nigeria contributed N41.1 billion compared with N47.2 billion in 2016, rest of Africa added N33.8 billion in 2017 against N24.3 billion in 2016, and outside Africa put N5.3 billion in 2017 in contrast to N3.4 billion in 2016.

Banking

How FairMoney Is Powering Financial Inclusion for Nigerian Hustlers

By Margaret Banasko

Urbanization is reshaping Nigeria’s economic landscape, creating new possibilities for millions of young people who relocate each year in search of opportunity. Cities like Lagos, Kano, and Abuja continue to expand as ambitious Nigerians leave their hometowns with the hope of building stable, sustainable livelihoods.

Recent figures highlight the pace of this shift. As of 2024, more than half of Nigeria’s population – around 128 million people – live in urban areas. Many of these individuals are young entrepreneurs and self-employed workers determined to turn their skills, ideas, and hustle into meaningful income. However, navigating the financial requirements needed to sustain and grow a small business is often challenging for those operating in informal or early-stage sectors.

This is where digital financial platforms have become transformational. With only a mobile phone, an internet connection, and a Bank Verification Number (BVN), Nigerians are increasingly able to access a wider range of financial tools designed to support their daily needs and long-term goals. FairMoney is among the institutions driving this progress by offering services that meet people where they are and support their ambition to grow.

Aigbe Osasere’s experience reflects this evolution. He moved from Benin City to Lagos with the goal of establishing a fish farming business in Ijegun, Alimosho. His vision was clear: create a small, efficient operation that could supply fresh fish to local buyers. Like many small business owners, he needed reliable access to funds to purchase fingerlings, buy feed, replace equipment, and maintain steady production. Managing these cycles required financial tools that matched the fast pace of his operations.

Through the FairMoney app, Aigbe gained access to digital banking services immediately after completing BVN verification. The availability of instant loans provided the flexibility he needed to restock quickly and maintain continuous production. For a business model where timing is central to profitability, this support allowed him to keep his operations consistent and responsive to customer demand.

Opening a FairMoney bank account and receiving a physical debit card further strengthened his business structure. Bulk buyers began paying him directly into his account, giving him clearer financial records and better visibility into his daily revenue. With his debit card, he could purchase supplies, withdraw cash conveniently, and manage his finances in a more organized way.

Aigbe also adopted FairMoney’s savings features to help him preserve and grow his earnings. By setting aside a portion of his daily sales, he is gradually building the capital needed to increase his fish tanks, expand his capacity, and move toward a more scalable operation.

Beyond supporting his business, FairMoney has become part of his everyday life. From the app, he sends money to family members, pays bills, buys airtime and data, and settles electricity tokens quickly and efficiently. This convenience allows him to focus more fully on running and growing his business.

Aigbe’s story is one example of how digital banking is broadening access to financial services across Nigeria. Entrepreneurs, freelancers, traders, and young workers are increasingly leveraging digital platforms to manage money, plan for growth, and participate more actively in the financial system.

As more Nigerians pursue self-employment and urban entrepreneurship, tools that offer accessibility, speed, and flexibility are playing an important role in supporting their progress. With FairMoney, many are finding a dependable partner that aligns with their goals, their pace, and their vision for the future.

Margaret Banasko is the Head of Marketing at FairMoney MFB

Banking

CBN Revokes Operating Licences of Aso Savings, Union Homes

By Adedapo Adesanya

The operating licences of Aso Savings and Loans Plc and Union Homes Savings and Loans Plc have been revoked by the Central Bank of Nigeria (CBN) as part of efforts to strengthen the mortgage sub-sector and enforce compliance with banking regulations.

Mortgage banks are financial institutions that provide home loans and other housing finance products, and so, they are strictly regulated by the CBN to protect customers and ensure the stability of Nigeria’s financial system.

According to a post by the Acting Director of Corporate Communications of CBN, Mrs Hakama Ali, on the apex bank’s X handle on Tuesday, the affected institutions were accused of violating several provisions of the Banks and Other Financial Institutions Act (BOFIA) 2020 and the Revised Guidelines for Mortgage Banks in Nigeria.

The revocation is part of the central bank’s ongoing efforts to maintain a safe and reliable banking sector, protect customers’ deposits, and ensure that only financially sound institutions operate in the mortgage market.

“The breaches included failure to meet the minimum paid-up share capital requirement, insufficient assets to meet liabilities, being critically undercapitalised with a capital adequacy ratio below the prudential minimum, and non-compliance with directives issued by the CBN,” the post noted.

The CBN emphasised that the revocation aligns with its mandate to ensure financial system stability and maintain public confidence in the banking sector, assuring it is committed to promoting a sound and resilient financial system in Nigeria.

Banking

Sagecom N225bn Case: Apex Court Cuts Fidelity Bank Judgment Debt to N30bn

By Adedapo Adesanya

A five-member panel of the Supreme Court, led by Justice Lawal Garba, last Friday ruled in favour of Fidelity Bank in its appeal against Sagecom Concepts Limited.

The judgment brings definitive closure to a legacy case that has attracted attention across the financial sector for more than two decades. It also marks a significant victory for Fidelity Bank in a long-running legal dispute.

In a motion dated October 8, 2025, Fidelity Bank sought clarification from the Supreme Court, requesting a consequential order that the judgment debt be paid in Naira. The bank also asked that the interest rate be set at 19.5 per cent per annum rather than 19.5 per cent compounded daily.

It also requested the exchange rate used for conversion be the rate applicable as of the date of the High Court judgment, in line with the Supreme Court’s decision in Anibaba v. Dana Airlines.

Fidelity Bank further requested the judgment debt be fixed at N30,197,286,603.13 and that interest on this amount be payable at 19.5 per cent per annum until full settlement.

In the judgment delivered by Justice Adamu Jauro, the apex court granted the bank’s first three prayers but declined the fourth and fifth. As a result, the judgment sum will be paid in Naira at an annual interest rate of 19.5 per cent, rather than the daily compounded rate previously awarded by the High Court.

The Supreme Court equally affirmed that the applicable exchange rate should be the rate as of the date of the High Court judgment, consistent with its earlier decision in Anibaba v. Dana Airlines.

The dispute originated from a legacy transaction involving the former FSB International Bank, which merged with Fidelity Bank in 2005. It stemmed from a 2002 credit facility extended to G. Cappa Plc and subsequent legal proceedings tied to the collateral.

This ruling provides finality for years of litigation and confirms a significantly lower liability than the N225 billion previously speculated in the review of decisions leading up to the decision.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn