Economy

Qfac Pick of the Week: United Bank for Africa (UBA) Plc

By Quantitative Financial Analytics Ltd

Though UBA Plc price fell from N11.24 to N11 during the last trading day, this week’s Qfac pick is United Bank for Africa, (UBA) Plc and our analysis is pointing to a buy signal.

United Bank for Africa Plc is a financial institution in Nigeria engaged in corporate, commercial and retail banking as well as trade services, cash management, treasury and custodial services with branches African countries. Our buy signal derives from the following:

Moving Average Analysis: The latest price of N11.00 beats its 5-Day, 5 5-Day, 50-Day, and 100-Day moving average prices. Most technical analysts use the moving average rule that recommends a buy when a market close crosses above x day moving average, while a sell is signalled when a market close crosses below x day moving average (where x could be any number of days)

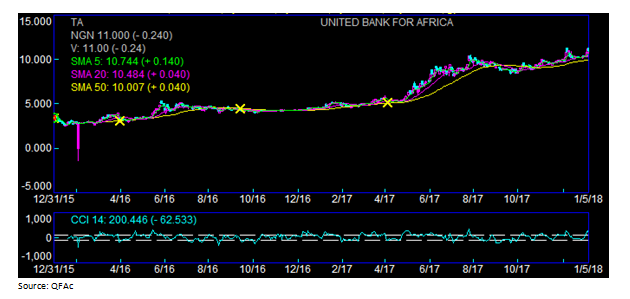

Commodity Channel Index: Though most chartists use the CCI as an overbought/oversold oscillator, it could be used to signal buys or sells. CCI compares current price with average price over a period of time CCI readings of above 100 indicate a buy while those below -100 indicate a sell. Our CCI index for UBA based on a 14- week period is 200.45

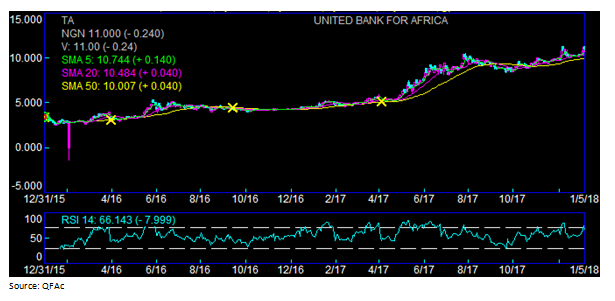

Relative Strength Index (RSI): According to Welles Wilder, who introduced RSI in 1978, market tops are often completed when the RSI rises above 70 while bottoms are formed during periods when the RSI falls below 30. Most analysts prepare to buy as prices dip below 30 using a rise back to 30 as a buy signal and prepare to sell when the RSI moves above 70. This is premised on the notion that RSI of 70 and above indicate that a stock is becoming overbought or overvalued and could be getting ready for a reversal while an RSI value of 30 and below indicate an oversell or an upcoming reversal. Our chart shows that UBA has an RSI of 66.143 which is below the overbought mark, we call it a buy especially for the day traders but could be a hold for longer tern traders.

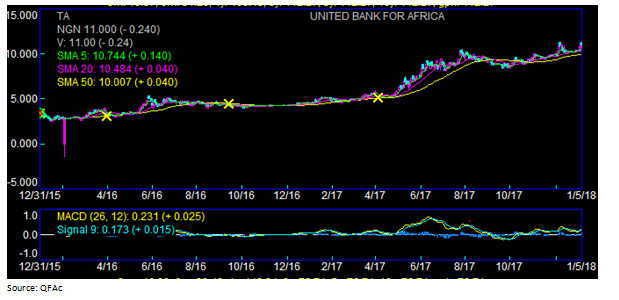

Moving Average Convergence Divergence (MACD): The MACD uses two lines to signal a buy or a sell, the faster line (MACD) and the slower line (signal). The actual buy or sell signals are given when the two lines cross, such that a crossing by the faster MACD line above the slower signal line indicates a buy while a crossing of the MACD line below the signal line indicates a sell. For UBA, the MACD line just crossed the signal line indicating a buy

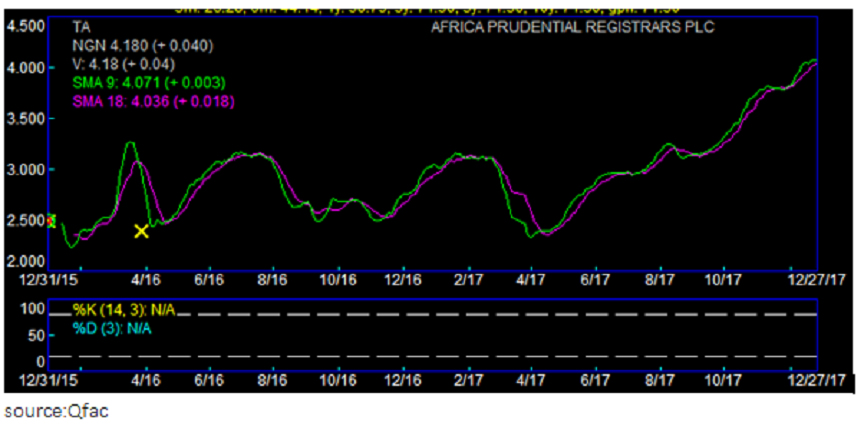

Stochastic Oscillator: The Stochastic indicator also uses two lines to signal buys or sells, the %K and %D lines. Buy signals are indicated when the fast %K line rises above 30 accompanied by a cross above the fast %D line while sell signals are indicated when the fast %K stochastic line falls below 80 and accompanied by a cross below the fast %D stochastic line.

As indicated above, the fast %K rose above 30 and crossed above the fast %D on December 27 indicating a buy.

Summary: Based on the above technical charts, we believe that the technical analysis is pointing to a buy signal for UBA.

For complete list of picks or for analysis of any stock of interest, contact [email protected]

Economy

Nigerian Stocks Close 1.13% Higher to Remain in Bulls’ Territory

By Dipo Olowookere

The local stock market firmed up by 1.13 per cent on Friday as appetite for Nigerian stocks remained strong.

Investors reacted well to the 2026 budget presentation of President Bola Tinubu to the National Assembly yesterday, especially because of the more realistic crude oil benchmark of $64 per barrel compared with the ambitious $75 per barrel for 2025. This year, prices have been between $60 and $65 per barrel.

Business Post observed profit-taking in the commodity and energy sectors as they respectively shed 0.14 per cent and 0.03 per cent.

But, bargain-hunting in the others sustained the positive run, with the consumer goods index up by 3.82 per cent.

Further, the industrial goods space appreciated by 1.46 per cent, the banking counter improved by 0.08 per cent, and the insurance industry gained 0.04 per cent.

As a result, the All-Share Index (ASI) increased by 1,694.33 points to 152,057.38 points from 150,363.05 points and the market capitalisation chalked up N1.080 trillion to finish at N96.937 trillion compared with Thursday’s closing value of N95.857 trillion.

A total of 34 shares ended on the advancers’ chart, while 24 were on the laggards’ log, representing a positive market breadth index and bullish investor sentiment.

Austin Laz gained 10.00 per cent to close at N2.42, Union Dicon also jumped 10.00 per cent to N6.60, Tantalizers increased by 9.80 per cent to N2.69, Aluminium Extrusion improved by 9.78 per cent to N12.35, and Champion Breweries grew by 9.71 per cent to N16.95.

Conversely, Sovereign Trust Insurance dipped by 7.42 per cent to N3.87, Royal Exchange lost 6.84 per cent to trade at N1.77, Omatek slipped by 6.84 per cent to N1.09, Eunisell depreciated by 5.88 per cent to N80.00, and Eterna dropped 5.63 per cent to close at N28.50.

Yesterday, traders transacted 1.5 billion units worth N21.8 billion in 25,667 deals compared with the 839.8 million units sold for N32.8 billion in 23,211 deals in the preceding session, showing a surge in the trading volume by 76.61 per cent, an uptick in the number of deals by 10.58 per cent, and a shrink in the trading value by 33.54 per cent.

Economy

FrieslandCampina, Two Others Erase N26bn from NASD OTC Bourse

By Adedapo Adesanya

Three stocks stretched the bearish run of the NASD Over-the-Counter (OTC) Securities Exchange by 1.21 per cent on Friday, December 19, with the market capitalisation giving up N26.01 billion to close at N2.121 billion compared with the N2.147 trillion it ended a day earlier, and the NASD Unlisted Security Index (NSI) dropping 43.47 points to 3,546.41 points from 3,589.88 points.

The trio of FrieslandCampina Wamco Nigeria Plc, Central Securities Clearing System (CSCS) Plc, and NASD Plc overpowered the gains printed by four other securities.

FrieslandCampina Wamco Nigeria Plc lost N6.00 to sell at N54.00 per unit versus N60.00 per unit, NASD Plc shrank by N3.50 to N58.50 per share from N55.00 per share, and CSCS Plc depleted by N2.91 to N33.87 per unit from N36.78 per unit.

On the flip side, Air Liquide Plc gained N1.01 to close at N13.00 per share versus N11.99 per share, Golden Capital Plc appreciated by 70 Kobo to N7.68 per unit from N6.98 per unit, Geo-Fluids Plc added 39 Kobo to sell at N5.50 per share versus N5.11 per share, and IPWA Plc rose by 8 Kobo to 85 Kobo per unit from 77 Kobo per unit.

During the trading day, market participants traded 1.9 million securities versus the previous day’s 30.5 million securities showing a decline of 49.3 per cent. The value of trades went down by 64.3 per cent to N80.3 million from N225.1 million, but the number of deals jumped by 32.1 per cent to 37 deals from 28 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc finished the session as the most active stock by value on a year-to-date basis with 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units traded for N4.9 billion.

The most active stock by volume on a year-to-date basis was still InfraCredit Plc with 5.8 billion units worth N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with 1.2 billion units sold for N420.7 million, and Impresit Bakolori Plc with 536.9 million units traded for N524.9 million.

Economy

Naira Crashes to N1,464/$1 at Official Market, N1,485/$1 at Black Market

By Adedapo Adesanya

It was not a good day for the Nigerian Naira at the two major foreign exchange (FX) market on Friday as it suffered a heavy loss against the United States Dollar at the close of transactions.

In the black market segment, the Naira weakened against its American counterpart yesterday by N10 to quote at N1,485/$1, in contrast to the N1,475/$1 it was traded a day earlier, and at the GTBank forex counter, it depreciated by N2 to settle at N1,467/$1 versus Thursday’s closing price of N1,465/$1.

In the Nigerian Autonomous Foreign Exchange Market (NAFEX) window, which is also the official market, the nation’s legal tender crashed against the greenback by N6.65 or 0.46 per cent to close at N1,464.49/$1 compared with the preceding session’s rate of N1,457.84/$1.

In the same vein, the local currency tumbled against the Euro in the spot market by N2.25 to sell for N1,714.63/€1 compared with the previous day’s N1,712.38/€1, but appreciated against the Pound Sterling by 73 Kobo to finish at N1,957.30/£1 compared with the N1,958.03/£1 it was traded in the preceding session.

The market continues to face seasonal pressure even as the Central Bank of Nigeria (CBN) is still conducting FX intervention sales, which have significantly reduced but not remove pressure from the Naira. Also, there seems to be reduced supply from exporters, foreign portfolio investors and non-bank corporate inflows.

President Bola Tinubu on Friday presented the government’s N58.47 trillion budget plan aimed at consolidating economic reforms and boosting growth.

The budget is based on a projected crude oil price of $64.85 a barrel and includes a target oil output of 1.84 million barrels a day. It also projects an exchange rate of N1,400 to the Dollar.

President Tinubu said inflation had plunged to an annual rate of 14.45 per cent in November from 24.23 per cent in March, while foreign reserves had surged to a seven-year high of $47 billion.

Meanwhile, the cryptocurrency market was dominated by the bulls but it continues to face increased pressure after million in liquidations in previous session over accelerating declines, with Dogecoin (DOGE) recovering 4.2 per cent to trade at $0.1309.

Further, Ripple (XRP) appreciated by 3.9 per cent to $1.90, Cardano (ADA) rose by 3.5 per cent to $0.3728, Solana (SOL) jumped by 3.4 per cent to $126.23, Ethereum (ETH) climbed by 2.9 per cent to $2,982.42, Binance Coin (BNB) gained 2.0 per cent to sell for $853.06, Bitcoin (BTC) improved by 1.7 per cent to $88,281.21, and Litecoin (LTC) soared by 1.2 per cent to $76.50, while the US Dollar Tether (USDT) and the US Dollar Coin (USDC) traded flat at $1.00 each.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn