Economy

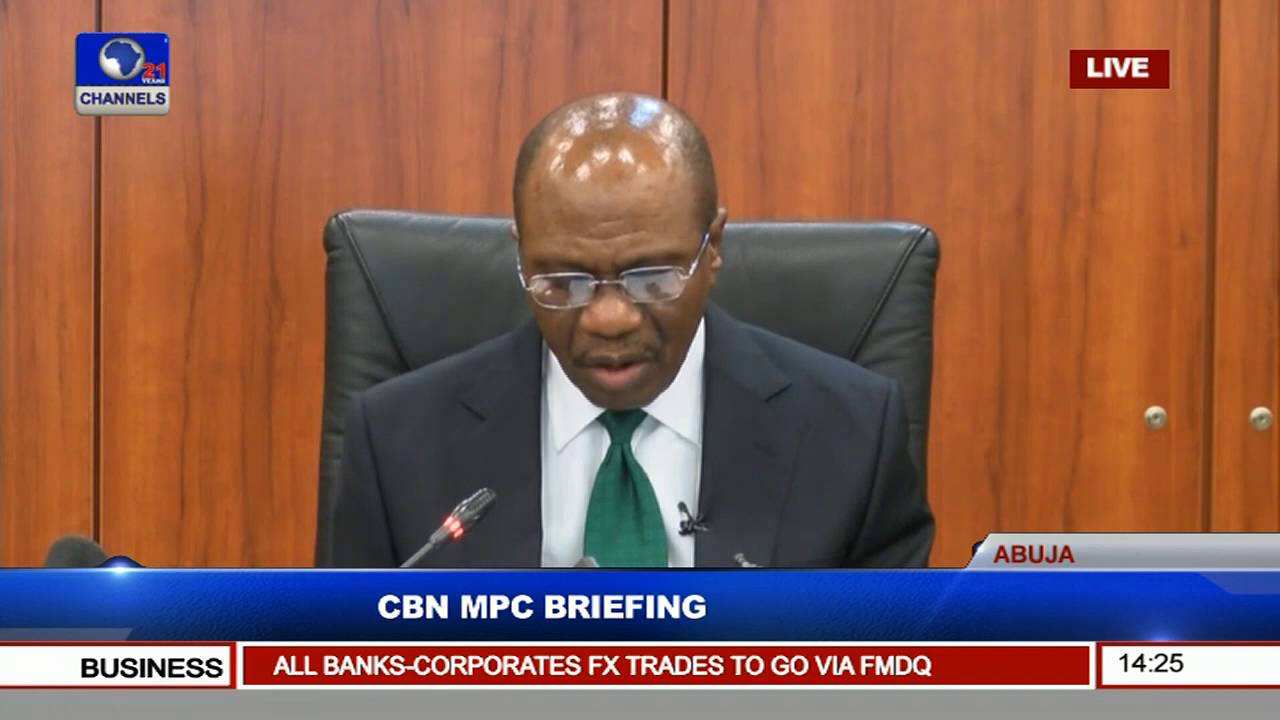

Economy: Investors Panic as CBN ‘Suspends’ MPC Meeting

By Modupe Gbadeyanka

With just two weeks left to the first meeting of the Monetary Policy Committee (MPC) meeting this year, it is not certain if the meeting will hold.

This is because the committee lacks the quorum to seat and the Senate, which is to screen and confirm nominees to fill the vacant positions, has refused to carry out this duty because of a face-0ff with the executive arm of government.

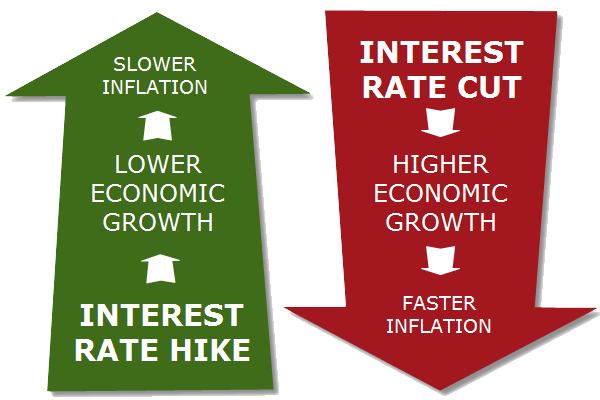

The MPC meeting is organised by the Central Bank of Nigeria (CBN) and it uses it to formulate monetary policies and set interest rates.

The committee comprises the CBN Governor, who acts as the chairman; the four deputy governors of the apex bank; two members of the board of directors of the chief lender; three members appointed by the President; and two members appointed by the Governor.

At the moment, eight positions on the 12-member committee are vacant, making it impossible for the committee to form a quorum.

With the crisis on ground, investors are already getting worried where this could lead the nation’s economy to.

Business Post gathered that investors and observers want the Senate and Presidency to quickly resolve the issue so as not to put the recovering economy into another crisis.

“It is a bad signal to investors. If the meeting fails to hold later this month, be rest assured that it would have a negative effect on the economy because it would surely bring panic amongst us,” an investor, Mr Sunday Akinremi, told Business Post on Monday.

The Senate is expected to resume from its recess on Tuesday, January 16, 2018, while the MPC meeting is scheduled to hold a week after.

According to a report by ThisDay, a Senator, who spoke on the condition of anonymity on Sunday, maintained that the position of the upper legislative chamber remained unchanged until the impasse regarding the nomination and non-confirmation of the acting chairman of the Economic and Financial Crimes Commission Crimes Commission (EFCC), Mr Ibrahim Magu, was resolved.

The lawmaker also said the Senate had resolved to seek legal interpretation of a comment made by Vice-President Yemi Osinbajo that the position of the EFCC chairman does not require the confirmation of the Senate, as it was not specified in the constitution.

As a result of Mr Osinbajo’s remark, the Senate had resolved to suspend the confirmation process for all nominees of the president not specifically mentioned in the 1999 Constitution, but are provided for in the establishment Acts of several agencies of the federal government such as the CBN, FIRS, NCC, and others.

The source explained: “What we are saying is that there is a need to test this in court. Since the vice-president, who is a lawyer, can pronounce that Magu does not need Senate confirmation and that his nomination should not have been sent to us in the first instance, then we queried why that of the MPC members were sent to the Senate.

“After all, the appointment of MPC members is also not contained in the constitution. So why was it sent to us? If we decline confirmation, would the executive not still interpret it the way they have chosen to interpret the issue with Mr Magu?

“Just like the EFCC chairmanship, the members of the MPC are not mentioned in our constitution.”

However, the lawmaker pointed out that the Senate has been confirming nominees of the president specifically mentioned in the constitution such as officials of the Independent National Electoral Commission (INEC).

When contacted, the spokesman of the Senate, Mr Sabi Aliyu Abdullahi, could not be reached for his reaction, as his mobile phones were switched off.

In a recent interview, he had told THISDAY that the resolution of the Senate was still in place until the impasse regarding Mr Magu was resolved.

The President had in October nominated Mrs Aisha Ahmad as deputy governor of the CBN to replace Mrs Sarah Alade, who retired from the Bank last June.

He also nominated Professor Adeola Festus Adenikinju, Dr Aliyu Rafindadi Sanusi, Dr Robert Chikwendu Asogwa and Dr Asheikh Maidugu as members of the MPC to fill the positions of four others whose tenure expired at the end of last year.

Similarly, the president had nominated five non-executive directors for the CBN, who have also not been confirmed by the Senate.

Meanwhile, Mr Suleiman Barau, another deputy governor of the central bank, who is also a member of the committee, retired last month.

The president is yet to name a replacement for him.

The delay in confirming the MPC nominees has led to uncertainty over the January meeting of the committee, which has operational independence in setting interest rates as well as formulating monetary policies for the country.

Speaking on the issue Sunday, a senior CBN official who pleaded to remain anonymous, said the matter was beyond the CBN.

She explained: “The CBN is not in a position to push for the confirmation of the nominees. It is something between the presidency and the Senate.

“We would have loved to get the confirmation so that our MPC and even the Board of Governors would be up and running.”

When asked about the likely implication of not holding the meeting, the CBN official said: “The implications are very clear. Apart from being a national disgrace, it would be an international embarrassment that the CBN cannot hold its MPC because of the lack of quorum. I don’t think it has ever happened to any country.”

Economy

Tinubu Presents N58.47trn Budget for 2026 to National Assembly

By Adedapo Adesanya

President Bola Tinubu on Friday presented a budget proposal of N58.47 trillion for the 2026 fiscal year titled Budget of Consolidation, Renewed Resilience and Shared Prosperity to a joint session of the National Assembly, with capital recurrent (non‑debt) expenditure standing at 15.25 trillion, and the capital expenditure at N26.08 trillion, while the crude oil benchmark was pegged at $64.85 per barrel.

Business Post reports that the Brent crude grade currently trades around $60 per barrel. It is also expected to trade at that level or lower next year over worries about oil glut.

At the budget presentation today, Mr Tinubu said the expected total revenue for the year is N34.33 trillion, and the proposal is anchored on a crude oil production of 1.84 million barrels per day, and an exchange rate of N1,400 to the US Dollar.

In terms of sectoral allocation, defence and security took the lion’s share with N5.41 trillion, followed by infrastructure at N3.56 trillion, education received N3.52 trillion, while health received N2.48 trillion.

Addressing the lawmakers, the President described the budget proposal as not “just accounting lines”.

“They are a statement of national priorities,” the president told the gathering. “We remain firmly committed to fiscal sustainability, debt transparency, and value‑for‑money spending.”

The presentation came at a time of heightened insecurity in parts of the country, with mass abductions and other crimes making headlines.

Outlining his government’s plan to address the challenge, President Tinubu reminded the gathering that security “remains the foundation of development”.

He said some of the measures in place to tame insecurity include the modernisation of the Armed Forces, intelligence‑driven policing and joint operations, border security, and technology‑enabled surveillance and community‑based peacebuilding and conflict prevention.

“We will invest in security with clear accountability for outcomes—because security spending must deliver security results,” the president said.

“To secure our country, our priority will remain on increasing the fighting capability of our armed forces and other security agencies by boosting personnel and procuring cutting-edge platforms and other hardware,” he added.

Economy

PenCom Extends Deadline for Pension Recapitalisation to June 2027

By Aduragbemi Omiyale

The deadline for the recapitalisation of the Nigerian pension industry has been extended by six months to June 2027 from December 2026.

This extension was approved by the National Pension Commission (PenCom), the agency, which regulates the sector in the country.

Addressing newsmen on Thursday in Lagos, the Director-General of PenCom, Ms Omolola Oloworaran, explained that the shift in deadline was to give operators more time to boost the capital base, dismissing speculations that the exercise had been suspended.

“The recapitalisation has not been suspended. We have communicated the requirements to the Pension Fund Administrators (PFAs), and we expect every operator to be compliant by June 2027. Anyone who is not compliant by then will lose their licence,” Ms Oloworaran told journalists.

She added that, “From a regulatory standpoint, our major challenge is ensuring compliance. We are working with ICPC, labour and the TUC to ensure employers remit pension contributions for their employees.”

The DG noted that engagements with industry operators indicated broad acceptance of the policy, with many PFAs already taking steps to raise additional capital or explore mergers and acquisitions.

“You may see some mergers and acquisitions in the industry, but what is clear is that the recapitalisation exercise is on track and the industry agrees with us,” she stated.

PenCom wants the PFAs to increase their capital base and has created three categories, with the first consists operators with Assets Under Management of N500 billion and above. They are expected to have a minimum capital of N20 billion and one per cent of AUM above N500 billion.

The second category has PFAs with AUM below N500 billion, which must have at least N20 billion as capital base.

The last segment comprises special-purpose PFAs such as NPF Pensions Limited, whose minimum capital was pegged at N30 billion, and the Nigerian University Pension Management Company Limited, whose minimum capital was fixed at N20 billion.

Economy

Three Securities Sink NASD Exchange by 0.68%

By Adedapo Adesanya

Three securities weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.68 per cent on Thursday, December 18.

According to data, Central Securities Clearing System (CSCS) Plc led the losers’ group after it slipped by N2.87 to N36.78 per share from N39.65 per share, Golden Capital Plc depreciated by 77 Kobo to end at N6.98 per unit versus the previous day’s N7.77 per unit, and FrieslandCampina Wamco Nigeria Plc dropped 19 Kobo to sell at N60.00 per share versus Wednesday’s closing price of N60.19 per share.

At the close of business, the market capitalisation lost N16.81 billion to finish at N2.147 billion compared with the preceding session’s N2.164 trillion, and the NASD Unlisted Security Index (NSI) declined by 24.76 points to 3,589.88 points from 3,614.64 points.

Yesterday, the volume of securities bought and sold increased by 49.3 per cent to 30.5 million units from 20.4 million units, the value of securities surged by 211.8 per cent to N225.1 million from N72.2 million, and the number of deals jumped by 33.3 per cent to 28 deals from 21 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc remained the most traded stock by value with a year-to-date sale of 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units worth N4.9 billion.

Similarly, InfraCredit Plc ended as the most traded stock by volume on a year-to-date basis with 5.8 billion units traded for N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with 1.2 billion units sold for N420.7 million, and Impresit Bakolori Plc with 536.9 million units exchanged for N524.9 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn