Economy

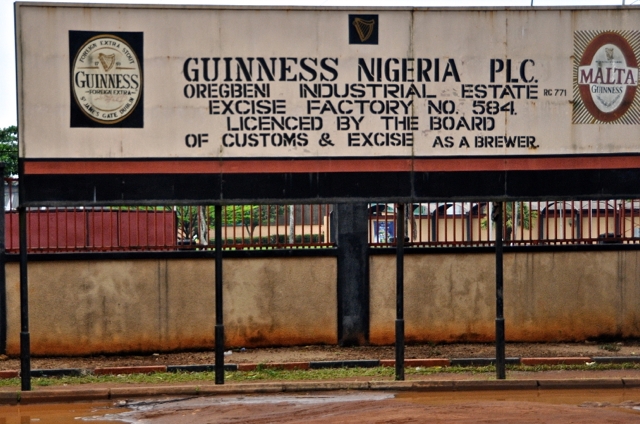

Guinness Nigeria Plc Begins N40b Rights Issue

By Modupe Gbadeyanka

Reports reaching us indicate that Guinness Nigeria Plc has now received clearance of the issue documents from the Securities and Exchange Commission (SEC) and approvals from the Nigerian Stock Exchange (NSE) to list the new Guinness Nigeria shares on the NSE.

This followed approval received in January from shareholders of the firm on the exercise.

A statement issued by Guinness Nigeria today disclosed that the funds raised will support the brewery company in executing its strategy in the context of ongoing external economic challenges.

Guinness Nigeria plans to raise a total of N39.7 billion by way of rights to existing shareholders, on the basis of 5 new shares for every 11 shares held by shareholders, whose names appeared in the register of members of the Company as at March 15, 2017 at an issue price of N58 per share.

The issue price represents a discount of 15 percent to the company’s closing share price on March 14, 2017, being the last day prior to the announcement of the proposed rights issue by the NSE.

Managing Director of Guinness Nigeria Plc, Mr Peter Ndegwa, was quoted in the statement as saying that, “This Rights Issue will allow the company to deliver on its strategic objectives and give all our shareholders a unique opportunity to increase the number of shares they hold.

“Our expectation is that funds raised will help mitigate the impact of increasing finance costs, optimize our balance sheet and improve the company’s financial flexibility.”

On his part, Chairman of Guinness Nigeria Plc, Mr Babatunde Savage, stated that this process is part of the firm’s long term plans to continue to invest in its business in Nigeria.

“We have been here in Nigeria for 67 years and, while it has been challenging in recent times for many Nigerian businesses, we remain committed to this market as evidenced by our decision to offer this Rights Issue.

“We are grateful for the support that we have received from our shareholders and other stakeholders up to this point,” Mr Savage said.

Last year, Guinness Nigeria Plc became the first total beverage alcohol company in Nigeria by acquiring the rights to distribute international premium spirits like Johnnie Walker whisky and Baileys liqueur in Nigeria and later commissioning a N4.7billionspirits line for locally manufactured spirits at its Benin plant.

Guinness Nigeria Plc has also been a champion for community development recently. Leveraging its flagship ‘Water of Life’ scheme, the company has delivered 35 water facilities across 24 states in Nigeria. These facilities have helped provide clean drinking water for over 1.5 million Nigerians.

Stanbic IBTC Capital Limited is acting for Guinness Nigeria Plc as Issuing House for the Rights Issue. Full terms of the Rights Issue will be set out in a Rights Circular to be mailed directly to shareholders of the Company, which contains a Provisional Allotment Letter and the Participation Form.

The company has urged investors to read the Rights Circular and where in doubt, consult their Stockbroker, Fund/Portfolio Manager, Accountant, Banker, Solicitor, or any other professional adviser for guidance before subscribing.

Economy

Lekki Deep Sea Port Reaches 50% Designed Operational Capacity

By Adedapo Adesanya

The Managing Director of Lekki Port LFTZ Enterprise Limited, Mr Wang Qiang, says the port has reached half of its designed operational capacity, with steady growth in container throughput since September 2025, reflecting increasing confidence by shipping lines and cargo owners in Nigeria’s first deep seaport.

“We already reached 50 per cent of our capacity now, almost 50 per cent of the port capacity.

“There is consistent improvement in the number of 20ft equivalent units (TEUs) handled monthly,” he said.

Mr Qiang explained further that efficient multimodal connectivity remains critical to sustaining and accelerating growth at the port.

According to him, barge operations have become an important evacuation channel and currently account for about 10 per cent of cargo movement from the port.

Mr Qiang mentioned that the ongoing Lagos–Calabar Coastal Road project would help ease congestion and improve access to the port.

He said that rail connectivity remained essential, particularly given the scale of industrial activities emerging within the Lekki corridor.

He said that Nigeria Government was concerned about the cargoes moving through rail and that the development would enhance more cargoes distribution outside the port.

Mr Qiang reiterated that Lekki port was a fully automated terminal, noting that delays may persist until all stakeholders, including government agencies, fully aligned with end-to-end digital processes.

He explained that customs procedures, particularly physical cargo examinations, and other port services should be fully digitalised to significantly reduce cargo dwell time.

“We must work together very closely with customers and all categories of operations for automation to yield results.

“Integration between the customs system, the terminal operating system and customers is already part of an agreed implementation schedule.

“For automation to work efficiently, all players must be ready — customers, government and every stakeholder. Only then can we have a fantastic system,” Mr Qiang said.

He also stressed that improved connectivity would allow the port to effectively double capacity through performance optimisation without expanding its physical footprint.

Economy

Investors Reaffirm Strong Confidence in Legend Internet With N10bn CP Oversubscription

By Aduragbemi Omiyale

The series 1 of the N10 billion Commercial Paper (CP) issuance of Legend Internet Plc recorded an oversubscription of 19.7 per cent from investors.

This reaffirmed the strong confidence in the company’s financial stability and growth trajectory.

The exercise is a critical component of Legend Internet’s N10 billion multi-layered financing programme, designed to support its medium- to long-term growth.

Proceeds are expected to be used for broadband infrastructure expansion to deepen nationwide penetration, optimise the organisation’s working capital for operational efficiency, strategic acquisitions that will strengthen its market position and accelerate service innovation.

The telecommunications firm sees the acceptance of the debt instruments as a response to its performance, credit profile, and disciplined operational structure, noting it also reflects continued trust in its ability to execute on its strategic vision for nationwide digital infrastructure expansion.

“The strong investor participation in our Series 1 Commercial Paper issuance is both encouraging and validating. It demonstrates the market’s belief in our financial integrity, operational strength, and long-term vision for digital infrastructure growth. This support fuels our commitment to building a more connected, competitive, and digitally enabled Nigeria.

“This milestone is not just a financing event; it is a strategic enabler of our expansion plans, working capital needs, and future acquisitions. We extend our sincere appreciation to our investors, advisers, and market partners whose confidence continues to propel Legend Internet forward,” the chief executive of Legend Internet, Ms Aisha Abdulaziz, commented.

Also commenting, the Chief Financial Officer of Legend Internet, Mr Chris Pitan, said, “This achievement is powered by our disciplined financing framework, which enables us to scale sustainably, innovate continuously, and consistently meet the evolving needs of our customers.

“We remain committed to building a future where every connection drives opportunity, productivity, and growth for communities across Nigeria.”

Economy

Tinubu to Present 2026 Budget to National Assembly Friday

By Adedapo Adesanya

President Bola Tinubu will, on Friday, present the 2026 Appropriation Bill to a joint session of the National Assembly.

The presentation, scheduled for 2:00 pm, was conveyed in a notice issued on Wednesday by the Office of the Clerk to the National Assembly.

According to the notice, all accredited persons are required to be at their duty posts by 11:00 am on the day of the presentation, as access into the National Assembly Complex will be restricted thereafter for security reasons.

The notice, signed by the Secretary, Human Resources and Staff Development, Mr Essien Eyo Essien, on behalf of the Clerk to the National Assembly, urged all concerned to ensure strict compliance with the arrangements ahead of the President’s budget presentation.

The 2026 budget is projected at N54.4 trillion, according to the approved 2026–2028 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP).

Meanwhile, President Tinubu has asked the National Assembly to repeal and re-enact the 2024 appropriation act in separate letters to the Senate and the House of Representatives on Wednesday and read during plenary by the presiding officers.

The bill was titled Appropriation (Repeal and Re-enactment Bill 2) 2024, involving a total proposed expenditure of N43.56 trillion.

In a letter dated December 16, 2025, the President said the bill seeks authorisation for the issuance of a total sum of N43.56 trillion from the Consolidated Revenue Fund of the Federation for the year ending December 31, 2025.

A breakdown of the proposed expenditure shows N1.74 trillion for statutory transfers, N8.27 trillion for debt service, N11.27 trillion for recurrent (non-debt) expenditure, and N22.28 trillion for capital expenditure and development fund contributions.

The President said the proposed legislation is aimed at ending the practice of running multiple budgets concurrently, while ensuring reasonable – indeed unprecedentedly high – capital performance rates on the 2024 and 2025 capital budgets.

He explained that the bill also provides a transparent and constitutionally grounded framework for consolidating and appropriating critical and time-sensitive expenditures undertaken in response to emergency situations, national security concerns, and other urgent needs.

President Tinubu added that the bill strengthens fiscal discipline and accountability by mandating that funds be released strictly for purposes approved by the National Assembly, restricting virement without prior legislative approval, and setting conditions for corrigenda in cases of genuine implementation errors.

The bill, which passed first and second reading in the House of Representatives, has been referred to the Committee on Appropriations for further legislative action.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn