Economy

Nigeria: Moody’s Predicts 2.5% GDP Growth in 2017, 4% in 2018

**Affirms Country’s B1 Rating With Stable Outlook

By Modupe Gbadeyanka

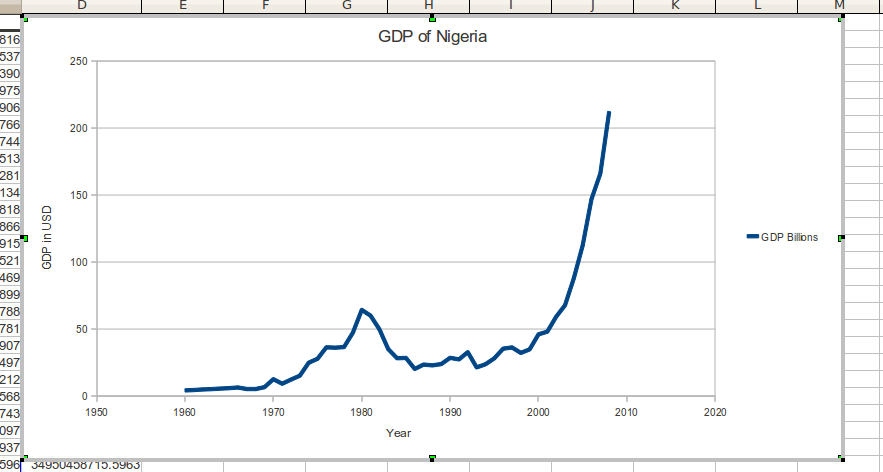

Moody’s Investors Service on Friday affirmed the B1 long-term issuer rating of the government of Nigeria with a stable outlook just as it forecasts that real GDP growth will rise to 2.5 percent in 2017 and accelerate further in 2018 to 4 percent.

The global rating firm disclosed that the key drivers for these were the medium term growth prospects remain robust despite the current challenging environment, with the rebound in oil production helping to rebalance the economy over the next two years; and the government’s balance sheet, which it said remains strong relative to its peers, resilient to the contractionary environment and temporarily elevated interest payments while the authorities pursue their efforts to grow non-oil taxes.

The long-term local-currency bond and deposit ceilings remain unchanged at Ba1. The long-term foreign-currency bond and deposit ceilings remain unchanged at Ba3 and B2, respectively.

Moody’s said it expects Nigeria’s medium term growth to remain robust, driven by the recovery in oil output and also over the near term, it expects Nigeria’s economic growth and US dollar earnings to improve in 2017, supported by a recovery in oil production.

According to Moody’s, after an estimated -1.5 percent real GDP growth in 2016, it forecasts real GDP growth to rise to 2.5% in 2017 and accelerate further in 2018 to 4%. A rebound in oil production to two million barrels per day (mbpd) will, if sustained, enhance economic growth and support the US dollar supply in the economy.

It noted that Nigeria has made significant gains in terms of governance and transparency in the oil sector. Improved availability of data, progress in restructuring the Nigerian National Petroleum Company (NNPC), rising effectiveness of operations at the refineries and a readiness to tackle difficult issues with partners (such as funding issues at the Joint Ventures) speak to a material improvement in the operating environment. The Petroleum Investment Bill (PIB bill), which had been blocked for 8 years in parliament, has been reactivated with a portion of the law drafted and passed by the Senate. Moreover, militant activity in the Niger Delta is set to wane following the resumption of payments from the government, though it will remain a threat to the recovery of the economy.

Moody’s further said the economy is also likely to benefit from the more timely implementation of the 2017 budget than its predecessor and in particular from the increase in capital spending on infrastructure which that will allow.

It also said the scarcity of Dollars, worsened by the soft capital controls imposed by the Central Bank of Nigeria (CBN), is likely to continue to negatively affect important sectors of the economy especially in services and manufacturing sectors.

“We do not expect the current policy mix to significantly change over the short term but a gradual easing of restrictions is possible as foreign currency receipts improve with rising oil production,” the firm said on Friday in a statement obtained by Business Post.

In 2017 and 2018, we expect Nigeria’s balance of payments to move back into surplus, supported by government external borrowings and a falling current account deficit. The latter is quickly reducing, supported by falling imports and increased oil production.

Depreciation of the naira, soft capital controls and current dollar scarcity have been relatively effective at constraining imports. We expect foreign exchange reserves to grow modestly in 2017. While improved foreign investor sentiment should support the rebalancing of the economy over the medium term, with the return of portfolio investors improving dollar liquidity in the country, the continued existence of a parallel, unofficial foreign exchange market is likely to act as a strong deterrent over the near term.

RESILIENT GOVERNMENT BALANCE SHEET STRONGER THAN PEERS’ DESPITE TURBULENCE

Moody’s says it expects the medium-term impact of the oil price shock on Nigeria’s government balance sheet to be contained, and recent erosion of debt affordability to be reversed.

The effect of the recent downturn on the government’s budget sheet has been contained as the authorities have been able to offset the shortfall in revenue with large cuts in capital expenditure. As a result, Moody’s forecasts a budget deficit of 3 percent of GDP in 2016, comprised of a 2 percent of GDP federal government budget deficit and around 1% of arrears split between federal, state and municipality levels of government, it explained.

Moody’s forecasts the federal government deficit to remain around 2% of GDP in 2017 and 2018, with large capital expenditure outlays resuming as the government’s cash flow situation improves. Based on these underlying projections, Nigeria’s balance sheet will continue to compare favourably with peers’, with government debt remaining well below 20% of GDP over the coming years against 55% median for B1-rated peers.

By end-2016, Moody’s estimates the government debt stock will be comprised of 85% domestic borrowing and 15% external debt, resulting in a manageable external debt profile. Government external debt amounts to just 2.9% of GDP, with interest payments set to remain low, at around $330 million dollars per annum. Domestic debt has increased significantly in recent years, reaching its current level of NGN10 trillion. Around 30% of this debt is comprised of costly T-bills, which have increased refinancing risk and interest rate exposure. However, Moody’s expects the ratio of interest payments to government revenues to peak at 20% for general government, and close to 40% of revenues for federal government in 2017.

Although debt service costs are high, Nigeria’s domestic capital market is sufficiently developed to accommodate the yearly public sector borrowing requirements of around NGN5.5 trillion. This is another positive credit feature that distinguishes Nigeria from many similarly rated peers. The country’s banking sector is well-capitalised and liquid and the national pension fund still has additional capacity. Should banking sector liquidity decline, the Central Bank of Nigeria has tools at its disposal to support appetite for government securities, including lowering the cash reserve requirement ratio from its presently high level of 22.5%. However, appetite for government securities remains strong, with all instruments remain oversubscribed.

Moody’s expects the recent increase in debt service costs to prove temporary, as a result of i) the government’ initiatives to expand the non-oil revenue base, and ii) efforts to improve the structure of government debt.

Measures by the Federal Revenue Inland Service are expected to increase non-oil revenue to around NGN4 trillion in 2016 from NGN2.5 trillion in 2015. These include a tax amnesty on penalties and interest on tax liabilities due in 2013, 2014 and 2015. However, not all the initiatives have proven successful: the independent re-appropriation of revenues from the ministries departments and agencies (MDAs) has yielded disappointing results so far. Such outcomes highlight the considerable execution risks inherent in the transition to a less oil-dependent federal budget, and the implications for the government balance sheet should it not meet its objectives.

The government’s medium-term debt strategy should also help to lower the interest burden. The debt strategy is geared towards exchanging costly short-term debt with long-term concessional borrowing. Although a portion of future external borrowings are expected to be raised through the Eurobond markets, this is likely to be complemented with ongoing support from other multilateral institutions including the African Development Bank and the World Bank. The combined effect of these measures should help to bring interest payments/general government revenues down to 16.8% by 2018, from an estimated 19.8% in 2016.

RATIONALE FOR THE OUTLOOK AT STABLE

The stable outlook is driven by Moody’s view that the downside risks posed by the weakening of the country’s fiscal strength, and the external and economic pressures anticipated this year and next, are balanced by Nigeria’s strengths, which exceed those of sovereigns rated below B1. In 2016, Nigeria’s external vulnerability indicator of 31% will remain far below the expected B1 median of 51%, while its debt-to-GDP of 16.6% will remain far below the expected B1 median of 55%. Set against that, its expected debt servicing burden in terms of interest payments to revenue of 19% is more than double the B1 median of 9%. To a large extent, Moody’s believes that this reflects Nigeria’s underdeveloped public sector revenue base, a credit weakness that the administration is attempting to address.

WHAT COULD CHANGE THE RATING UP

Positive pressure on Nigeria’s issuer rating will be exerted upon: 1) successful implementation of structural reforms by the Buhari administration, in particular with respect to public resource management and the broadening of the revenue base; 2) strong improvement in institutional strength with respect to corruption, government effectiveness, and the rule of law; 3) the rebuilding of large financial buffers sufficient to shelter the economy against a prolonged period of oil price and production volatility.

WHAT COULD CHANGE THE RATING DOWN

Nigeria’s B1 issuer rating could be downgraded in the event of 1) a greater-than-anticipated deterioration in the government’s balance sheet or continued erosion of debt affordability, for example resulting from the failure to implement revenue reform; and 2) lower than expected medium term growth, for example as a result of delays in implementing key structural reforms, especially in the oil sector, or continued militancy in the Niger Delta, which undermine the level of oil production over the medium-term.

GDP per capita (PPP basis, US$): 6,184 (2015 Actual) (also known as Per Capita Income)

Real GDP growth (% change): -1.5% (2016 Estimate) (also known as GDP Growth)

Inflation Rate (CPI, % change Dec/Dec): 19% (2016 Estimate)

Gen. Gov. Financial Balance/GDP: -2.9% (2016 Estimate) (also known as Fiscal Balance)

Current Account Balance/GDP: -0.6% (2016 Estimate) (also known as External Balance)

External debt/GDP: 4.2% (2016 Estimate)

Level of economic development: Low level of economic resilience

Default history: No default events (on bonds or loans) have been recorded since 1983.

On 7 December 2016, a rating committee was called to discuss the ratings of the Government of Nigeria. The main points raised during the discussion were: The issuer’s economic fundamentals, including its economic strength, have not materially changed. The issuer’s fiscal or financial strength, including its debt profile, has not materially changed. The issuer’s susceptibility to event risks has not materially changed. Other views raised included: the issuer’s institutional strength/framework, have not materially changed. The issuer’s governance and/or management, have not materially changed.

The principal methodology used in these ratings was Sovereign Bond Ratings published in December 2015. Please see the Rating Methodologies page on www.moodys.com for a copy of this methodology.

The weighting of all rating factors is described in the methodology used in this credit rating action, if applicable.

Economy

Tinubu Presents N58.47trn Budget for 2026 to National Assembly

By Adedapo Adesanya

President Bola Tinubu on Friday presented a budget proposal of N58.47 trillion for the 2026 fiscal year titled Budget of Consolidation, Renewed Resilience and Shared Prosperity to a joint session of the National Assembly, with capital recurrent (non‑debt) expenditure standing at 15.25 trillion, and the capital expenditure at N26.08 trillion, while the crude oil benchmark was pegged at $64.85 per barrel.

Business Post reports that the Brent crude grade currently trades around $60 per barrel. It is also expected to trade at that level or lower next year over worries about oil glut.

At the budget presentation today, Mr Tinubu said the expected total revenue for the year is N34.33 trillion, and the proposal is anchored on a crude oil production of 1.84 million barrels per day, and an exchange rate of N1,400 to the US Dollar.

In terms of sectoral allocation, defence and security took the lion’s share with N5.41 trillion, followed by infrastructure at N3.56 trillion, education received N3.52 trillion, while health received N2.48 trillion.

Addressing the lawmakers, the President described the budget proposal as not “just accounting lines”.

“They are a statement of national priorities,” the president told the gathering. “We remain firmly committed to fiscal sustainability, debt transparency, and value‑for‑money spending.”

The presentation came at a time of heightened insecurity in parts of the country, with mass abductions and other crimes making headlines.

Outlining his government’s plan to address the challenge, President Tinubu reminded the gathering that security “remains the foundation of development”.

He said some of the measures in place to tame insecurity include the modernisation of the Armed Forces, intelligence‑driven policing and joint operations, border security, and technology‑enabled surveillance and community‑based peacebuilding and conflict prevention.

“We will invest in security with clear accountability for outcomes—because security spending must deliver security results,” the president said.

“To secure our country, our priority will remain on increasing the fighting capability of our armed forces and other security agencies by boosting personnel and procuring cutting-edge platforms and other hardware,” he added.

Economy

PenCom Extends Deadline for Pension Recapitalisation to June 2027

By Aduragbemi Omiyale

The deadline for the recapitalisation of the Nigerian pension industry has been extended by six months to June 2027 from December 2026.

This extension was approved by the National Pension Commission (PenCom), the agency, which regulates the sector in the country.

Addressing newsmen on Thursday in Lagos, the Director-General of PenCom, Ms Omolola Oloworaran, explained that the shift in deadline was to give operators more time to boost the capital base, dismissing speculations that the exercise had been suspended.

“The recapitalisation has not been suspended. We have communicated the requirements to the Pension Fund Administrators (PFAs), and we expect every operator to be compliant by June 2027. Anyone who is not compliant by then will lose their licence,” Ms Oloworaran told journalists.

She added that, “From a regulatory standpoint, our major challenge is ensuring compliance. We are working with ICPC, labour and the TUC to ensure employers remit pension contributions for their employees.”

The DG noted that engagements with industry operators indicated broad acceptance of the policy, with many PFAs already taking steps to raise additional capital or explore mergers and acquisitions.

“You may see some mergers and acquisitions in the industry, but what is clear is that the recapitalisation exercise is on track and the industry agrees with us,” she stated.

PenCom wants the PFAs to increase their capital base and has created three categories, with the first consists operators with Assets Under Management of N500 billion and above. They are expected to have a minimum capital of N20 billion and one per cent of AUM above N500 billion.

The second category has PFAs with AUM below N500 billion, which must have at least N20 billion as capital base.

The last segment comprises special-purpose PFAs such as NPF Pensions Limited, whose minimum capital was pegged at N30 billion, and the Nigerian University Pension Management Company Limited, whose minimum capital was fixed at N20 billion.

Economy

Three Securities Sink NASD Exchange by 0.68%

By Adedapo Adesanya

Three securities weakened the NASD Over-the-Counter (OTC) Securities Exchange by 0.68 per cent on Thursday, December 18.

According to data, Central Securities Clearing System (CSCS) Plc led the losers’ group after it slipped by N2.87 to N36.78 per share from N39.65 per share, Golden Capital Plc depreciated by 77 Kobo to end at N6.98 per unit versus the previous day’s N7.77 per unit, and FrieslandCampina Wamco Nigeria Plc dropped 19 Kobo to sell at N60.00 per share versus Wednesday’s closing price of N60.19 per share.

At the close of business, the market capitalisation lost N16.81 billion to finish at N2.147 billion compared with the preceding session’s N2.164 trillion, and the NASD Unlisted Security Index (NSI) declined by 24.76 points to 3,589.88 points from 3,614.64 points.

Yesterday, the volume of securities bought and sold increased by 49.3 per cent to 30.5 million units from 20.4 million units, the value of securities surged by 211.8 per cent to N225.1 million from N72.2 million, and the number of deals jumped by 33.3 per cent to 28 deals from 21 deals.

Infrastructure Credit Guarantee Company (InfraCredit) Plc remained the most traded stock by value with a year-to-date sale of 5.8 billion units valued at N16.4 billion, followed by Okitipupa Plc with 178.9 million units transacted for N9.5 billion, and MRS Oil Plc with 36.1 million units worth N4.9 billion.

Similarly, InfraCredit Plc ended as the most traded stock by volume on a year-to-date basis with 5.8 billion units traded for N16.4 billion, trailed by Industrial and General Insurance (IGI) Plc with 1.2 billion units sold for N420.7 million, and Impresit Bakolori Plc with 536.9 million units exchanged for N524.9 million.

-

Feature/OPED6 years ago

Feature/OPED6 years agoDavos was Different this year

-

Travel/Tourism9 years ago

Lagos Seals Western Lodge Hotel In Ikorodu

-

Showbiz3 years ago

Showbiz3 years agoEstranged Lover Releases Videos of Empress Njamah Bathing

-

Banking7 years ago

Banking7 years agoSort Codes of GTBank Branches in Nigeria

-

Economy3 years ago

Economy3 years agoSubsidy Removal: CNG at N130 Per Litre Cheaper Than Petrol—IPMAN

-

Banking3 years ago

Banking3 years agoFirst Bank Announces Planned Downtime

-

Banking3 years ago

Banking3 years agoSort Codes of UBA Branches in Nigeria

-

Sports3 years ago

Sports3 years agoHighest Paid Nigerian Footballer – How Much Do Nigerian Footballers Earn